This requires that national levels of GDP be converted to a common currency before the comparisons can be made.

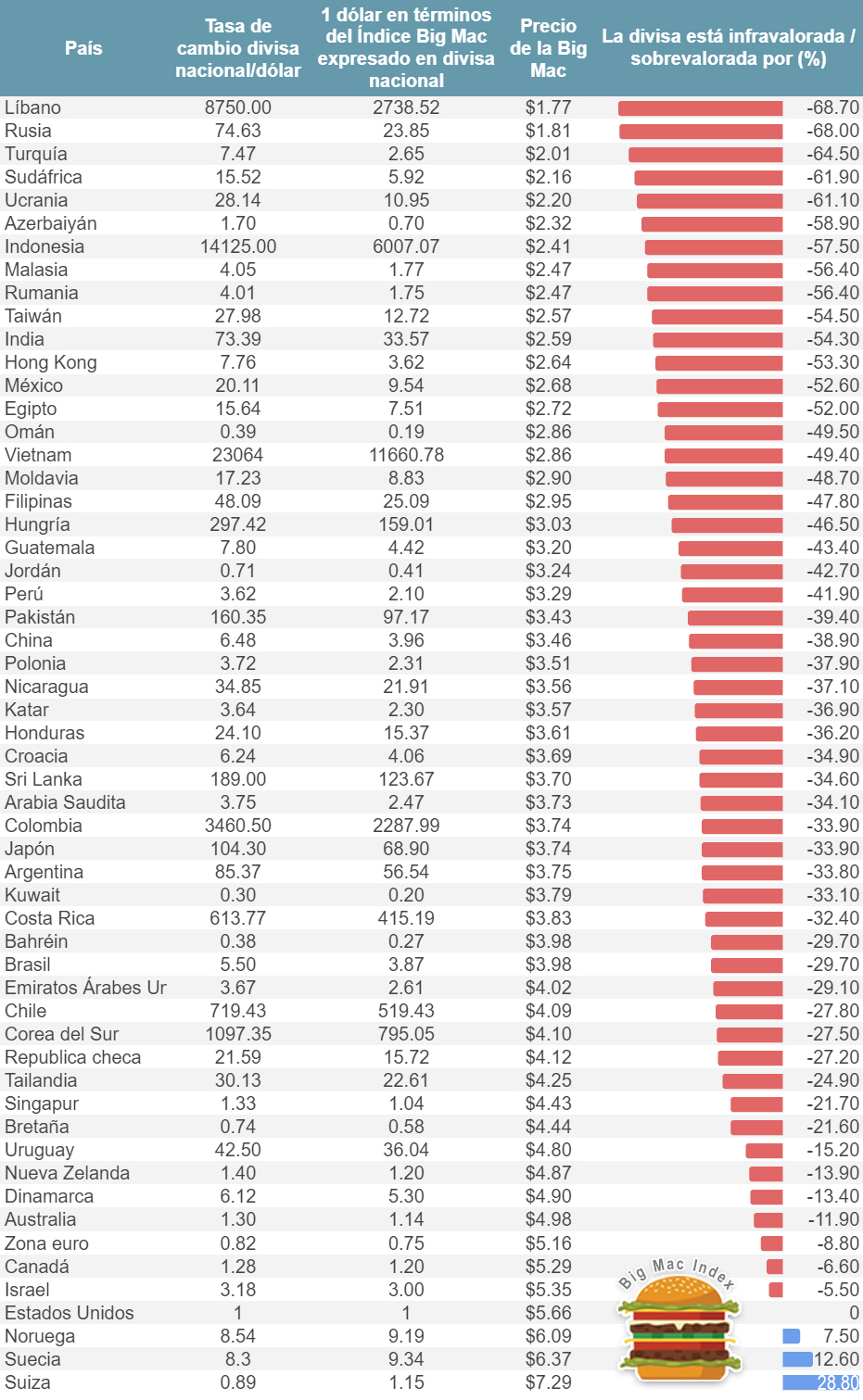

(7) Take the actual exchange rate for the foreign currency (in our example they had to pay €.739) to buy a dollar and multiply it by the Big Mac price in the US (always $3.57) to find out how much in dollars it will cost the foreigner to buy a Big Mac in the US.Based on the official documentation from the World Bank (particularly Chapter 1):Ī problem that has challenged economists comparing economies across national boundaries is that the GDP of a country is expressed in its national currency. (6) Take the actual exchange rate for a holder of dollars (in our example we had to pay $1.353) to buy the currency and mulitply it by the Big Mac price in the foreign country to get how much in dollars the Big Mac will cost you. In our example above-a dollar bought €.739 and a euro bought $1.35. (5) Find the ACTUAL exchange rate for (1) a dollar to buy _(corresponding currency) and (2)_(corresponding currency) to buy a dollar. (4).(2) and (3) give you the PPP exchange rate (3) Take the reciprocal of the number you found in (2) to determine "How many dollars does it take to buy_(insert name of currency)" (2) This will give the foreign currency price per dollar (in PPP), or "How many _(insert name of currency) does it take to buy $1.00". (1) To find PPP take the Big Mac Price in the local currency and divide it by the Big Mac Price in Dollars ($3.57 everytime) To find out what a Big Mac will actually cost dollar holders, we take the Big Mac price in euros, €3.31, and multiply it by actual exchange rate of $1.353 which equals $4.48! AND if a holder of Euros exchanges their Euros for Dollars to buy a Big Mac in the US, they will pay $3.57 multiplied by the actual exchange rate of €.739 which equals $2.69! Not a deal for holders of dollars BUT a deal for holders of Euros. This means, according to PPP, $1.00 will exchange for €.927 and the reciprocal, €1.00 will exchange for $1.078. If we take the Big Mac in Euros divided by the price in Dollars we will get a PPP exchange rate of Euros in terms of Dollars-€3.31/$3.57 = €.927. The Economist uses a Big Mac price of $3.57 in the US. A Big Mac in the Euro area costs €3.31. However, it gives as some idea of what exchanges SHOULD be and then we can compare them to what the REALLY are in the Foreign Exchange Market and determine if currencies are over-valued or under-valuded relative to each other.Here is an example: It is by no means a perfect measurment and there are many variables that may account for differences in costs of producing a Big Mac in, say, New York compared to Mexico City.

PPP suggests that over time the prices of similar goods SHOULD be relatively EQUAL in terms of the purchasing power of the local currency it takes to buy it, REGARDLESS of the currency or country it is sold in. The Big Mac Index is a creation of The Economist magazine.It is a measurement of an important economic concept called Purchasing Power Parity, or "PPP" for short.

0 kommentar(er)

0 kommentar(er)